The New Frugality

By: Chris Farrell

First off, sorry for the delay. We were a little behind this week, and it didn’t help that this has a couple of slow bits. The biggest reason for the 3-star rating was the fact I could never spend more than 20 – 30 minutes at a time in the book. I didn’t finish until this morning.

This is a personal finance book for socially conscious people. Chris Farrell touches on common personal finance wisdom while blending moral investing principles throughout the book. For example, sustainability was perhaps a dozen times throughout. I thought the concept of morally responsible investing makes a lot of sense. The concept is simple, don’t invest your money in businesses that you believe to be morally bankrupt. In the United States, this concept goes back to when the Baptist Abolitionist refused to invest any money in the Atlantic slave trade.

A core idea in this book is the margin of safety. The margin of safety is a buffer that allows an individual to absorb unexpected expenditures without a negative impact to financial security and quality of life. Farrell believes this can rule can be used during many of life’s chapters. For example, don’t buy a house without at least 20% down. This gives you immediate equity in your home, so in the event you need to relocate suddenly, you do not sustain a loss when you sell your house. This could also be applied during college. Education is important, especially in today’s economy. That doesn’t mean you have to take on a debt at all cost in order to complete one. Ignoring the fact that college tuition surged 439% from 1982 to 2007 while incomes only increased 147% is asking for trouble. Instead, try and find ways to avoid incurring so much student debt. For example, go to community college for the first 2 years then transfer to a name brand university after that.

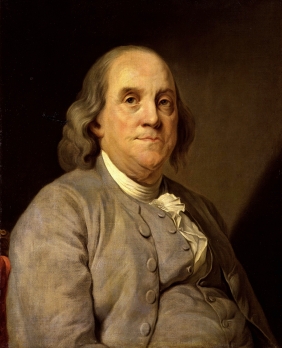

Of course, this book also contains its fair share of conventional personal finance wisdom as well. He quotes Benjamin Franklin often in the last chapter. A few I liked include

“If you would be wealthy, think of saving as well as getting”

“He that goes a-borrowing foes a-sorrowing”

“The borrower is slave to the lender, the debtor to the creditor.”

While the information is good, I can’t ignore the fact that this book did not hold my attention very well. Also, the information inserts on every other page proved to be more of a detraction that a help understanding the content. If you are just starting out learning about personal finance, I would definitely recommend The Simple Path to Wealth before this one.

over and out,

Jacob